How job ghosting is driving gen-z

How job ghosting is driving gen-z into depression, Although it seems like something from Halloween, the term “ghost jobs” descri

Impact of Real Estate on Climate is becoming impossible to ignore. If you’ve been watching the real estate scene in Pakistan this year, you’ve probably noticed the shift. Things feel different in 2025. Investors are more confident, developers are adjusting priorities, and buyers are focusing on climate resilience more than ever.

Money is finally moving again. About 88 percent of investors believe their revenue will increase this year, and more than half expect to grow by at least 5 percent. After the slowdowns of previous years, this optimism feels earned.

What They’re Expecting, Percentage

Higher earnings, 88%

Growth above 5%, 60%

Pakistan is facing one of its toughest flood seasons in years due to Impact of Real Estate on Climate. Early estimates show the country has suffered more than Rs822 billion in economic losses, with close to seventy districts hit hard. A government report called A Preliminary Assessment of Flood Damages in the Economy of Pakistan (2025) outlines the scale of the crisis.

It confirms that more than one thousand people have lost their lives and over four million have been forced from their homes. Entire communities are dealing with destroyed houses, ruined crops, and major damage to roads and other essential infrastructure.

Real estate is investing heavily in tech. Not because it sounds good in presentations, but because firms need better data and smarter tools to stay competitive. Around 81 percent plan to increase their tech spending in 2025, while only 7 percent are thinking about cutting back. That alone says a lot about Impact of Real Estate on Climate and where the industry is heading.

Where the Money’s Going, Percentage

More tech and data spending, 81%

Budget cuts, 7%

AI is no longer a fancy buzzword. It’s actually being used to support real decisions, from pricing to energy planning to customer experience. In Islamabad Impact of Real Estate on Climate is improving, developers are using AI tools to analyze land, predict demand and fine-tune project designs.

Of course, adopting AI isn’t simple. Good data is hard to find, skilled talent is even harder and initial costs can make companies hesitate. But once the systems are in place, the long-term benefits are hard to ignore.

Impact of Real Estate on Climate isn’t a background issue anymore. It’s shaping the way cities grow, how buyers choose homes and how developers plan their projects.

The report breaks down the financial hit across key sectors and puts the total damage at about Rs822 billion. Agriculture took the biggest blow with losses reaching Rs430 billion.

Infrastructure followed with another Rs307 billion in damage. Homes across the country faced roughly Rs92 billion in destruction, and the power sector added another Rs25 billion to the overall bill.

The floods that hit parts of Pakistan and nearby regions earlier this year were a harsh reminder of what’s at stake. Torrential rainfall, cloudbursts and overflowing rivers damaged homes, roads, industries and entire low-lying zones.

People in Islamabad felt the ripple effect, even if the city wasn’t hit hardest. After the floods, buyers immediately began asking different questions. Is the area prone to water logging? Does the project have proper drainage? How strong is the elevation? Developers had to respond quickly all of this just because of Impact of Real Estate on Climate.

Energy use in buildings is a major contributor to emissions, so the shift toward green construction is finally gaining momentum. In Islamabad, better insulation, solar setups and high-efficiency cooling systems are turning into real selling points.

Green Solution, Benefit

Strong insulation, Lower energy use

Solar and renewables, Reduced dependence on the grid

Efficient heating and cooling, Big energy savings

Improved building envelopes, Better long-term performance

These upgrades cost more upfront, but in the long run they save money, improve comfort and help shield buildings from climate extremes.

The push toward net-zero buildings is getting serious. Developers are considering the Impact of Real Estate on Climate so cleaner materials, improved insulation, energy audits and electrified heating and cooling. Islamabad is slowly moving toward this direction, mostly in projects that want to stand out in a crowded market.

Net-Zero Strategy, Key Technologies

Cleaner operations, Efficient electrification and stronger insulation

Energy audits, Identifying retrofit opportunities

Feasibility studies, Understanding long-term returns

How AI Helps Cut Emissions

AI is becoming an important tool in sustainability planning. It highlights energy waste, helps reduce operating costs and guides long-term green strategies.

Elaan Marketing is part of this shift, encouraging climate-conscious architectural designs, better planning decisions and project concepts that take flooding, heat and sustainability more seriously.

Let’s talk about where the market is leaning in 2025.

Interest Rates and Market Activity

Borrowing costs have eased slightly, which usually encourages more buying and selling. The economy still feels cautious, so returns might fluctuate, but overall momentum is better than last year.

Year, Rate Trend, Impact

2025, Slight decline, More transactions

2026, Uncertain, Possible income pressure

Local demand is rising in well-planned, better-protected zones:

Buyers now pay more attention to flood resilience, open spaces and environmental planning than before.2500 years old gt road the golden investment belt for all the investors.

New construction has slowed significantly, especially in office and industrial projects. This drop creates pressure on supply and pushes investors back toward existing high-quality properties.

Property Type, Construction Drop

Office, 73%

Industrial, 56%

For early investors, this shift opens better long-term opportunities.

2025 is shaping up to be a recovery year. Investors who stayed patient during the past few slow cycles are looking forward to higher revenue, improved financing conditions and a more active market.

Outlook for Real Assets

Real assets are regaining popularity. Islamabad is benefiting from this interest, especially in mixed-use developments, greener communities and projects built around convenience and long-term value.

The commercial market is adjusting to new habits and new expectations. Retail is improving, industrial demand is rising with logistics, multi-family housing is still strong and hospitality is slowly finding its pace again.

Strengthening Fundamentals

Sustainability is no longer optional. Tech integration, climate-aware architecture and lifestyle-focused amenities are becoming key elements that attract younger buyers.

Developers in Islamabad, including organizations like Ovaisco Builders, are responding with designs that can handle heavy rains,as this city is the most beautiful capital in the world, offer better energy performance and allow communities to live more comfortably due to Impact of Real Estate on Climate.

How job ghosting is driving gen-z into depression, Although it seems like something from Halloween, the term “ghost jobs” descri

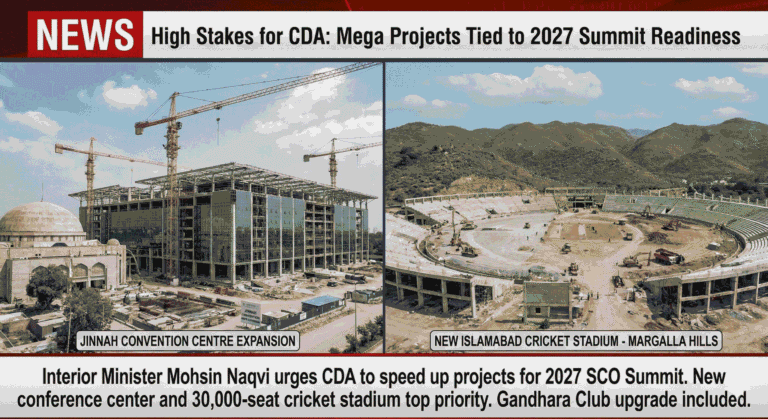

High Stakes for CDA Mega Projects Tied, As Islamabad’s development plans pick up speed, authorities ordered the CDA to construct massi

How world is evolving with new business strategies while business is changing everywhere, and Pakistan is right in the middle of that shift.

A simple 90-second children’s song changed everything. 90 Seconds clip earns $400 million, Baby Shark explores how an unexpected viral vid

Real Estate Market Outlook 2025 Impact of Real Estate on Climate is becoming impossible to ignore. If you’ve been watching the real estate

Opportunities in Islamabad for developers as Islamabad's real estate market is on the rise.

What does this ordinance mean? Punjab CM Approves Punjab Protection of Ownership Ordinance 2025, a new law designed to protect citizens’ p

Why Socities get banned in Islamabad explained in detail, covering illegal housing schemes, CDA rules, common real estate scams, and how to

Discover why Elaan Marketing is the Best Real Estate Company in Islamabad, offering trusted, legally approved projects, high-rise developmen